Creating a monthly budget sounds simple in theory—just track your income, list your expenses, and make sure you don’t spend more than you earn. But in reality, most budgets fail within the first few weeks. Why? Because they’re either too restrictive, too complicated, or simply unrealistic for everyday life.

Many Americans start budgeting with good intentions. They download an app, create a spreadsheet, or write down their expenses only to abandon the plan when unexpected costs pop up or when they feel deprived. A budget that feels like punishment won’t last. A budget that ignores real-life spending habits won’t work.

The truth is, a successful monthly budget isn’t about perfection. It’s about creating a flexible system that fits your lifestyle, income level, and financial goals. A budget should reduce stress—not create it. It should give you clarity and confidence, not guilt.

When done correctly, a monthly budget becomes a powerful financial tool. It helps you:

- Stop living paycheck to paycheck

- Build an emergency fund

- Pay off debt faster

- Save for long-term goals

- Feel more in control of your money

In this guide, you’ll learn how to create a monthly budget that actually works, one that’s realistic, sustainable, and adaptable to your real life. Whether you’re new to budgeting or have struggled in the past, this step-by-step approach will help you build a system you can stick to.

Step 1: Calculate Your True Monthly Income

Start with your net income (after taxes), not your gross salary.

Include:

- Full-time job income

- Side hustle earnings

- Freelance or gig income

- Any consistent additional income

If your income fluctuates, use the average of the last 3–6 months to create stability in your planning.

Clarity begins with an accurate number.

Step 2: Track Your Expenses Honestly

Before setting limits, understand where your money currently goes.

Review:

- Bank statements

- Credit card transactions

- Subscription payments

Break expenses into categories:

- Housing

- Utilities

- Groceries

- Transportation

- Insurance

- Debt payments

- Entertainment

- Dining out

- Shopping

Many people underestimate spending, especially on small daily purchases.

Awareness is power.

Step 3: Choose a Budgeting Framework

You don’t need something complicated. Choose a system that matches your personality.

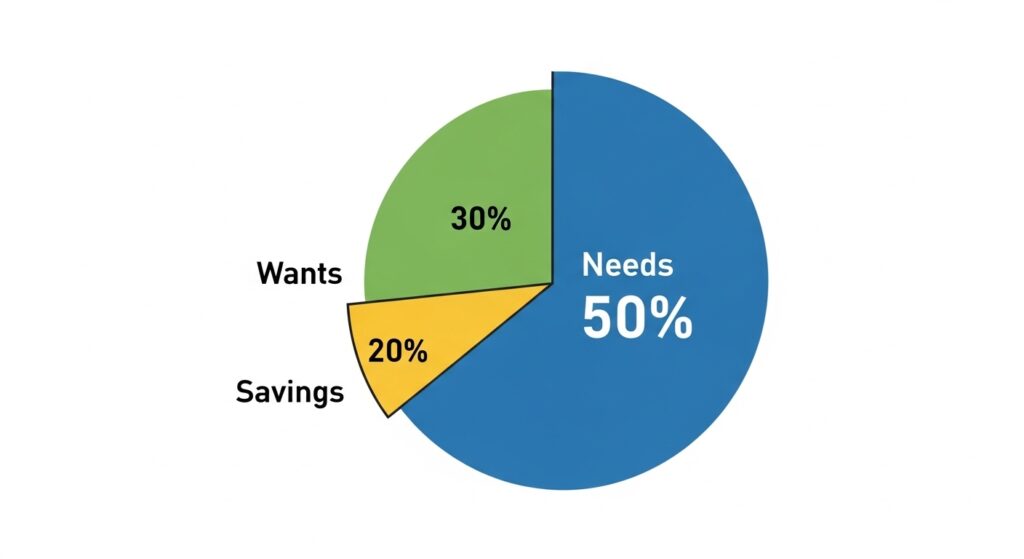

Option 1: The 50/30/20 Rule

- 50% Needs

- 30% Wants

- 20% Savings/Debt

Option 2: Zero-Based Budget

Assign every dollar a job so income minus expenses equals zero.

Option 3: Cash Envelope System

Use cash for variable spending categories to avoid overspending.

The best budget is the one you’ll actually use.

Step 4: Build in Flexibility

Rigid budgets fail.

Add:

- A small “miscellaneous” category

- A buffer for unexpected expenses

- Realistic amounts for fun spending

If you completely remove enjoyment, you’ll abandon the plan. Sustainability matters more than strictness.

Step 5: Automate Savings First

Pay yourself first.

Set up automatic transfers to:

- Emergency fund

- Retirement account

- Investment account

When savings happen automatically, you remove temptation and decision fatigue.

Step 6: Plan for Irregular Expenses

Car maintenance, gifts, holidays, and annual subscriptions—these are predictable even if they aren’t monthly.

Create a sinking fund:

Divide annual costs by 12 and save a small amount each month.

This prevents financial surprises.

Step 7: Review and Adjust Monthly

Life changes. Income changes. Expenses change.

Schedule a monthly budget review:

- Adjust categories

- Evaluate progress

- Identify overspending

- Set new goals

Budgeting is a process, not a one-time task.

Common Reasons Budgets Fail

- Setting unrealistic spending limits

- Ignoring small purchases

- Forgetting irregular expenses

- Trying to copy someone else’s system

- Not reviewing regularly

Your budget must match your real life.

Conclusion

A monthly budget that actually works isn’t about restriction—it’s about direction. It tells your money where to go instead of wondering where it went.

By calculating your true income, tracking expenses honestly, choosing a realistic system, building flexibility, automating savings, and reviewing regularly, you create a sustainable financial plan.

Remember: The goal isn’t to be perfect. The goal is to be consistent.

Start simple. Stay flexible. And build a system that supports your future.