Saving money often feels overwhelming. When people hear “Save $500 in one month,” their first reaction is usually stress. They imagine cutting out everything they enjoy, eating instant noodles for weeks, or saying no to every social invitation. But saving money doesn’t have to feel like punishment. In fact, when done correctly, it can feel empowering.

For many Americans, $500 can make a meaningful difference. It could jumpstart an emergency fund, help pay off credit card debt, cover unexpected car repairs, or simply provide peace of mind. Yet the challenge isn’t always about income — it’s about strategy. Most people don’t fail at saving because they don’t make enough money. They struggle because they try to make drastic changes too quickly.

The truth is, saving $500 in 30 days is completely possible without turning your life upside down. The key is making small, intentional adjustments rather than extreme sacrifices. When you shift your mindset from “restriction” to “optimization,” saving becomes less stressful and more manageable.

In this guide, you’ll learn practical, realistic strategies to save $500 in one month — without feeling deprived, overwhelmed, or exhausted. These methods are flexible and can work whether you’re living paycheck to paycheck or simply trying to improve your financial habits.

Let’s break it down step by step.

1. Start With a Clear $500 Game Plan

Instead of randomly trying to “spend less,” divide $500 into manageable chunks.

For example:

- $125 per week

- About $17 per day

When you break it down, it feels much more achievable. Having a clear weekly target prevents last-minute panic at the end of the month.

2. Cut 3 “Invisible” Expenses Immediately

Most people waste money on things they barely notice.

Examples:

- Unused subscriptions (streaming services, apps, memberships)

- Automatic renewals

- Premium upgrades you don’t need

Canceling just 2–3 subscriptions could easily save $50–$100 in one month without affecting your lifestyle much at all.

3. Do a 30-Day “Pause Rule” on Wants

This doesn’t mean you can’t buy anything fun.

It means:

If it’s not essential, wait 30 days.

You’ll be surprised how many “wants” disappear after a few days. This alone can save $100–$200 in impulse purchases.

4. Lower Grocery Costs Without Extreme Couponing

Groceries are one of the easiest areas to optimize.

Simple changes:

- Plan meals before shopping

- Stick to a grocery list

- Buy store brands

- Cook at home 5 nights per week

Even reducing grocery spending by $25 per week saves $100 in a month.

5. Use the “Cash for Extras” Method

Withdraw a set amount of cash for non-essentials like dining out, coffee, or entertainment.

When the cash is gone, you’re done spending in that category.

This creates awareness without requiring complicated budgeting apps.

6. Negotiate or Lower Monthly Bills

Call your:

- Internet provider

- Phone company

- Insurance provider

Ask for promotions or better rates. Many companies offer discounts if you simply ask.

Even saving $20–$50 helps move you toward that $500 goal.

7. Sell 5 Things You Don’t Use

Look around your home.

Old electronics, clothes, small appliances, furniture, collectibles — many items can be sold quickly through online marketplaces.

Selling just 5 items could easily generate $100–$300.

8. Try a Small Temporary Side Boost

You don’t need a second job.

Consider:

- Freelance micro-tasks

- Selling digital products

- Pet sitting

- Babysitting

- Doing small neighborhood services

Even an extra $125 this month significantly reduces the pressure on cutting expenses.

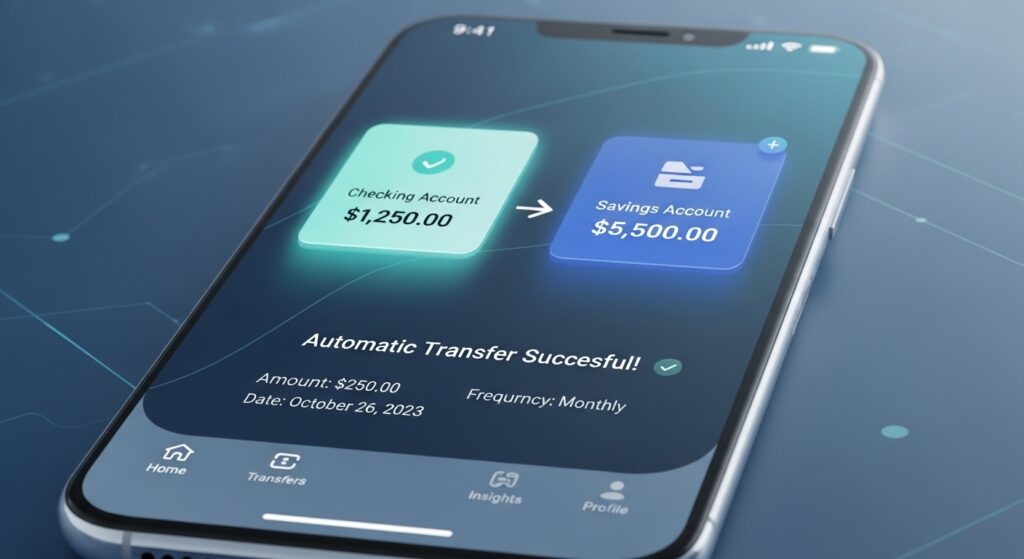

9. Automate the Savings

Transfer money weekly into a separate savings account.

When savings are automatic, you remove the emotional decision-making process.

Out of sight, out of mind.

10. Focus on Progress, Not Perfection

If you save $420 instead of $500, that’s still a win.

Financial growth is about building habits, not chasing unrealistic standards. The goal is momentum, not misery.

Conclusion

Saving $500 in one month doesn’t require extreme sacrifice. It requires awareness, small intentional adjustments, and consistency. When you approach saving strategically rather than emotionally, the process becomes far less stressful.

Remember: financial peace isn’t built overnight. But one focused month can completely shift your confidence and habits.

Start small. Stay consistent. And watch how quickly progress adds up.