Growing your money doesn’t require winning the lottery, inheriting wealth, or becoming a Wall Street expert. In fact, some of the most successful investors follow simple, consistent strategies that anyone can apply. The difference between people who build wealth and those who struggle financially often comes down to one key habit: investing early and consistently.

Many Americans keep their savings sitting in traditional bank accounts, earning little to no interest. While saving money is important, simply storing cash rarely keeps up with inflation. Over time, the purchasing power of idle money decreases. That’s why investing is essential if you want your money to grow.

Investing may sound intimidating at first. Stock market fluctuations, economic headlines, and financial jargon can make it feel complicated or risky. But the truth is, you don’t need to be a financial professional to start growing your money. With today’s technology and accessible investment platforms in the U.S., getting started is easier than ever.

The key is understanding that investing is not about getting rich quickly. It’s about building wealth steadily over time through smart decisions, diversification, and consistency. Even small amounts invested regularly can grow significantly thanks to compound interest.

In this article, you’ll discover 5 easy and beginner-friendly ways to grow your money with investments. These strategies are practical, proven, and suitable for individuals at various income levels. Whether you’re just starting out or looking to improve your financial strategy, these methods can help you build long-term wealth with confidence.

1. Invest in Index Funds

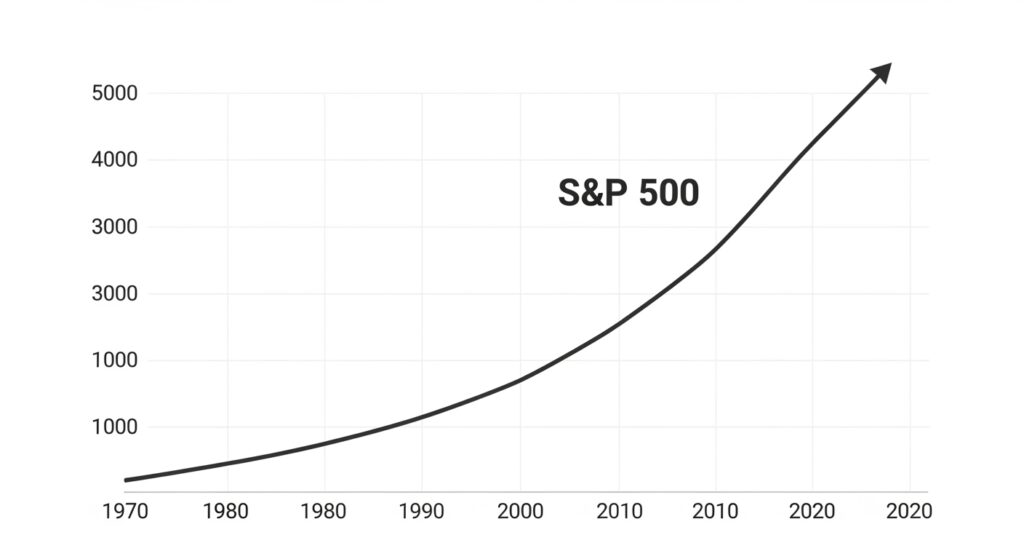

One of the easiest and most reliable ways to grow your money is through index funds.

Index funds track major market indexes like:

- The S&P 500

- The Total U.S. Stock Market

Instead of trying to pick winning stocks, index funds allow you to invest in hundreds of companies at once. This diversification reduces risk and historically provides steady long-term returns.

Why it works:

- Low fees

- Broad diversification

- Strong historical performance

For beginners, this is often the simplest and smartest starting point.

2. Take Advantage of Employer 401(k) Matching

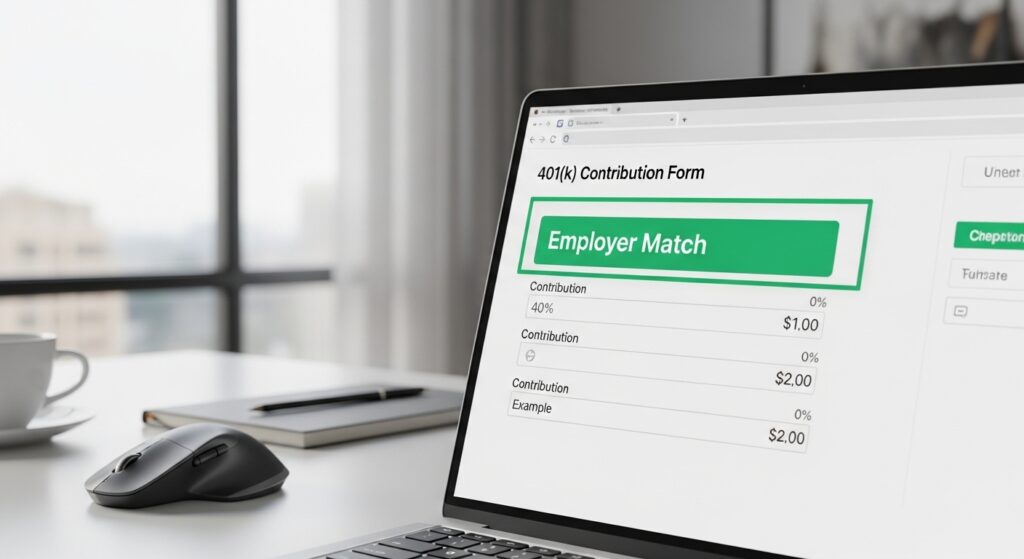

If your employer offers a 401(k) plan with matching contributions, this is one of the easiest ways to grow your money.

For example:

If your employer matches 4% of your salary, contributing at least 4% gives you an immediate 100% return on that portion.

Benefits:

- Automatic payroll deductions

- Tax advantages

- Employer contributions

It’s essentially free money that accelerates your investment growth.

3. Open a Roth IRA

A Roth IRA is another powerful investment tool in the U.S.

Key advantages:

- Contributions grow tax-free

- Withdrawals in retirement are tax-free

- Flexible investment options

Because your earnings compound without future tax liability, long-term growth can be significant—especially if you start early.

4. Invest Consistently Through Dollar-Cost Averaging

Trying to time the market is difficult, even for professionals. Instead, use a strategy called dollar-cost averaging.

This means:

- Investing a fixed amount regularly (weekly or monthly)

- Buying more shares when prices are low

- Buying fewer shares when prices are high

Over time, this reduces the impact of market volatility and builds disciplined investing habits.

Consistency often beats perfection.

5. Reinvest Dividends for Compound Growth

Many investments pay dividends—small payouts to shareholders.

Instead of withdrawing dividends:

Reinvest them.

This allows your earnings to generate additional earnings over time. Compound growth becomes powerful when dividends are automatically reinvested.

The longer you stay invested, the stronger this effect becomes.

Conclusion

Growing your money through investments doesn’t require complicated strategies or risky decisions. By investing in index funds, using retirement accounts like 401(k)s and Roth IRAs, investing consistently, and reinvesting dividends, you create a simple yet powerful wealth-building system.

The most important step is starting.

Even small amounts invested regularly can grow into substantial wealth over time. Investing is not about speed—it’s about patience, discipline, and letting compound growth work for you.

Start simple. Stay consistent. Let time do the heavy lifting.