Managing money can often feel like trying to navigate a maze with no map. From juggling bills and rent to saving for the future, many Americans find themselves stressed and overwhelmed by their finances. Yet, the truth is that achieving financial stability doesn’t have to be complicated. The key lies in budgeting—a simple, practical approach to understanding where your money goes, making informed decisions, and ultimately reaching your financial goals.

Budgeting isn’t just for those struggling to make ends meet. It’s a powerful tool for anyone who wants to take control of their financial future, whether you’re a college student paying off student loans, a young professional trying to save for a home, or someone preparing for retirement. A well-planned budget helps you identify unnecessary spending, build savings, pay off debt, and even prepare for life’s unexpected expenses.

In this article, we’ll break down 10 essential budgeting tips every American should know. These strategies are practical, easy to implement, and designed to fit a variety of lifestyles and income levels. By following these tips, you’ll not only gain a clearer understanding of your finances but also feel empowered to make smarter choices that can lead to long-term financial freedom.

Whether you’re new to budgeting or looking for ways to improve your current financial habits, this guide will provide the insights and tools you need to take control of your money and secure a more confident, stress-free financial future.

1. Track Your Spending

Before you can budget effectively, you need to know where your money goes. Use apps like Mint or YNAB, or even a simple spreadsheet, to record every expense. Awareness is the first step toward smarter spending.

2. Set Clear Goals

Whether it’s saving for an emergency fund, retirement, or a vacation, define your short-term and long-term financial goals. Clear goals make it easier to prioritize spending and stay motivated.

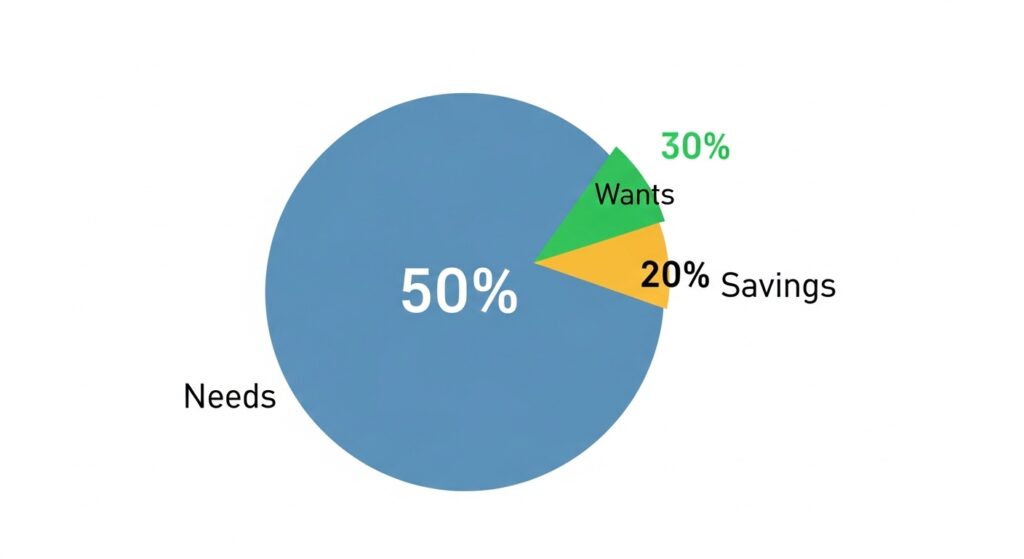

3. Follow the 50/30/20 Rule

A popular budgeting framework:

- 50% for needs (rent, groceries, utilities)

- 30% for wants (entertainment, dining out)

- 20% for savings and debt repayment

This simple structure can help balance your finances without feeling restrictive.

4. Build an Emergency Fund

Unexpected expenses happen—car repairs, medical bills, job loss. Aim to save at least 3–6 months’ worth of living expenses in an easily accessible account.

5. Cut Unnecessary Expenses

Review subscriptions, memberships, or recurring purchases. Cancel what you don’t use or negotiate lower rates. Small savings add up over time.

6. Automate Savings

Set up automatic transfers to your savings or investment accounts. Automating reduces the temptation to spend and ensures you’re consistently building wealth.

7. Pay Off High-Interest Debt First

Prioritize paying off credit card debt or loans with high interest rates. This reduces financial stress and frees up money for other goals.

8. Use Cash for Discretionary Spending

For non-essential expenses, try using cash or a prepaid card. Physically seeing the money leave your hands can help curb overspending.

9. Monitor Your Credit Score

Your credit score affects loans, interest rates, and even job applications. Regularly check your score and take steps to improve it, such as paying bills on time and reducing debt.

10. Review and Adjust Your Budget Monthly

Your financial situation and goals can change, so review your budget at least once a month. Adjust for any changes in income, expenses, or priorities to stay on track.

Conclusion:

Budgeting is not about restriction—it’s about freedom. By implementing these tips, you can take control of your finances, reduce stress, and work toward your goals with confidence. Start today, and your future self will thank you.