Freelancing and side hustling offer something traditional jobs often don’t: flexibility, independence, and unlimited income potential. You can choose your clients, control your schedule, and scale your earnings based on effort and skill. But along with that freedom comes a financial challenge many new freelancers underestimate—inconsistent income.

Unlike a salaried employee who receives the same paycheck every month, freelancers and side hustlers often experience fluctuating earnings. One month might bring multiple clients and strong cash flow, while the next month may feel painfully slow. This income volatility can create stress, overspending during high-income months, and financial anxiety during slower periods.

Without a structured budgeting system, it’s easy to feel like your money controls you rather than the other way around.

The key to financial stability as a freelancer is not earning more—it’s managing irregular income strategically. When you learn how to budget as a freelancer, you transform unpredictable earnings into predictable financial security.

Budgeting as a freelancer requires a different mindset than traditional budgeting. You must plan for taxes, prepare for slow seasons, smooth out income fluctuations, and prioritize saving during strong months. When done correctly, freelancing can actually accelerate wealth-building because income ceilings are higher than fixed salaries.

In this guide, you’ll learn practical, proven strategies to budget effectively as a freelancer or side hustler—even if your income changes every month.

1. Calculate Your Baseline Monthly Expenses

Before planning your income, understand your essential expenses.

List your fixed necessities:

- Rent or mortgage

- Utilities

- Insurance

- Minimum debt payments

- Groceries

- Transportation

This is your “bare minimum survival number.”

Knowing this number gives you clarity. It tells you how much income you must generate each month to remain stable.

2. Pay Yourself a Fixed Salary

One of the most effective strategies for freelancers is creating a personal “salary.”

Here’s how it works:

- Deposit all freelance income into a separate business account.

- Pay yourself a fixed amount monthly based on your average earnings.

For example:

If you average $4,000 per month but sometimes earn $6,000 and sometimes $2,500, you might pay yourself $3,500 consistently and keep the rest in a buffer account.

This creates income stability—even when your earnings fluctuate.

3. Build a Large Emergency Fund

Freelancers need a bigger safety net than salaried employees.

Instead of 3 months of expenses, aim for:

- 6–12 months of essential expenses

This fund protects you during:

- Client loss

- Slow seasons

- Economic downturns

- Personal emergencies

Financial confidence increases when you know you can survive lean months.

4. Separate Business and Personal Finances

Blurring business and personal money leads to confusion and tax problems.

Open:

- A business checking account

- A separate savings account for taxes

Transfer only your “salary” to your personal account.

This structure simplifies bookkeeping and improves financial clarity.

5. Save for Taxes Automatically

Freelancers are responsible for their own taxes.

A smart rule:

- Set aside 25–30% of every payment for taxes (the percentage depends on your country).

Transfer this money immediately into a dedicated tax savings account.

Avoid spending tax money accidentally—it creates unnecessary stress later.

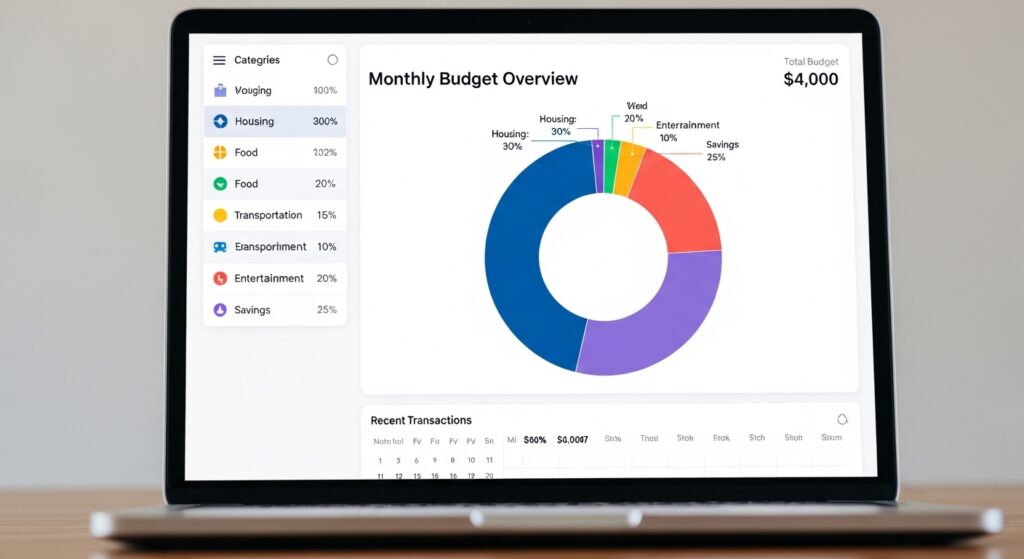

6. Use a Percentage-Based Budget

Since freelance income varies, percentage budgeting works better than fixed numbers.

Example structure:

- 50% necessities

- 20% savings/investing

- 10% taxes (if not separated already)

- 20% lifestyle

Adjust percentages based on your goals.

When income increases, your savings automatically increase too.

7. Create a “Slow Month” Fund

Beyond your emergency fund, build a business buffer.

During high-income months:

- Save excess earnings

- Avoid upgrading your lifestyle immediately

Use this buffer to smooth out low-income months without panic.

This prevents the cycle of overspending during good months and struggling during slow one

8. Track Income Trends

Review your income patterns over:

- 6 months

- 12 months

- Seasonal cycles

Many freelancers discover predictable slow periods.

When you anticipate income dips, you can prepare in advance instead of reacting emotionally.

9. Avoid Lifestyle Inflation During Good Months

When income spikes, the temptation to upgrade your lifestyle increases.

Instead:

- Increase savings rate

- Invest surplus earnings

- Pay down debt

- Strengthen your financial cushion

Freelancers who control lifestyle inflation build wealth much faster.

10. Invest Consistently

Freelancing offers high-income potential—but only if you convert income into assets.

Automate:

- Retirement contributions

- Index fund investments

- Long-term savings

Your future security depends on investing consistently, not just earning.

Common Budgeting Mistakes Freelancers Make

- Spending based on the highest earning month

- Ignoring taxes

- Not separating accounts

- Underestimating slow seasons

- Failing to build emergency reserves

Avoiding these mistakes creates financial stability even with unpredictable income.

Conclusion

Freelancing and side hustling can offer financial freedom — but only if managed wisely.

To budget as a freelancer successfully:

- Know your essential expenses

- Pay yourself a fixed salary

- Build a larger emergency fund

- Save for taxes automatically

- Use percentage-based budgeting

- Avoid lifestyle inflation

- Invest consistently

Irregular income does not have to mean financial instability. With the right system, you can turn unpredictable earnings into steady progress toward long-term financial freedom.