Tracking your expenses sounds simple in theory. Write down what you spend. Review it. Adjust. Save more.

But in reality, many people start tracking their expenses with enthusiasm—only to quit weeks later. Why? Most systems feel complicated, time-consuming, or restrictive. Spreadsheets become confusing. Budget apps send too many notifications. Receipts pile up. Categories multiply. What begins as motivation turns into frustration.

The problem isn’t that expense tracking doesn’t work. The problem is that many people try to track everything perfectly.

Financial clarity does not require perfection. It requires consistency and simplicity.

When done correctly, tracking expenses should reduce stress—not create it. It should provide awareness, not guilt. It should give you control over your money without making you feel controlled by a system.

The truth is, you don’t need a complex budgeting framework to understand where your money goes. You need a sustainable method that fits your personality, lifestyle, and financial goals. Whether you prefer apps, notebooks, or automated systems, the key is choosing a method you can maintain long-term.

In this guide, you’ll learn how to track your expenses without overwhelm by simplifying categories, automating where possible, and focusing on progress rather than perfection.

1. Start With Awareness, Not Restriction

The first goal of expense tracking is awareness, not cutting spending immediately.

For your first 30 days:

- Simply observe where your money goes.

- Record purchases without judgment.

- Avoid making drastic changes.

This removes pressure and helps you build the habit without stress.

Awareness naturally leads to smarter decisions.

2. Use Broad Categories Only

Too many categories create confusion.

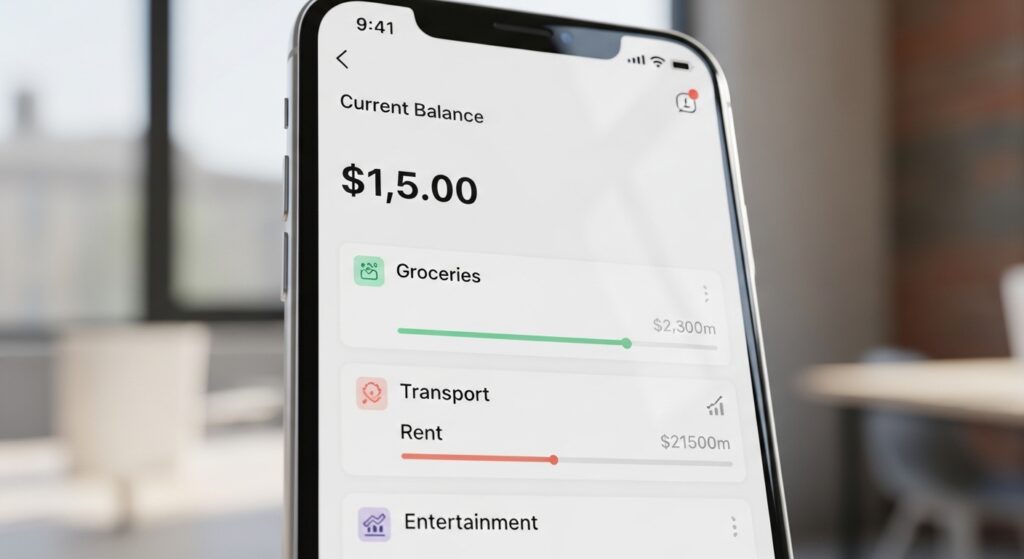

Instead of 25 spending categories, use 4–6 broad ones:

- Housing

- Food

- Transportation

- Utilities

- Lifestyle

- Savings

Broad categories make tracking faster and easier to maintain.

Simplicity increases consistency.

3. Choose One Tracking Method

Avoid mixing multiple systems.

You can choose:

- A budgeting app

- A simple spreadsheet

- A notes app on your phone

- A small pocket notebook

Pick one method and commit to it for at least 60 days.

Consistency beats complexity.

4. Track Weekly, Not Daily

Daily tracking can feel exhausting.

Instead:

- Set one weekly “money check-in”

- Review transactions

- Categorize spending

- Make small adjustments

A 20-minute weekly session is more sustainable than daily logging.

Create a routine—for example, Sunday evenings.

5. Automate Fixed Expenses

Automation reduces effort dramatically.

Set up:

- Automatic bill payments

- Automatic savings transfers

- Automatic investments

The fewer manual tasks you have, the less overwhelmed you feel.

Automation turns budgeting into a background process.

6. Focus on the Big Three

Most budgets are heavily impacted by three categories:

- Housing

- Transportation

- Food

Instead of obsessing over small purchases, evaluate these large areas first.

Small daily coffee purchases matter less than large recurring commitments.

7. Create a “No-Guilt” Spending Category

Strict budgets often fail because they feel restrictive.

Include:

- A flexible personal spending category

- An entertainment allowance

- A small “fun money” fund

When you plan for enjoyment, you reduce impulse spending.

Balance control with flexibility.

8. Review Trends, Not Individual Purchases

Instead of analyzing every expense, look at patterns:

- Are food costs increasing monthly?

- Is online shopping becoming frequent?

- Are subscriptions adding up?

Trends provide insight without emotional stress.

Zoom out for clarity.

9. Forgive Imperfection

You will miss entries. You will forget receipts. You may overspend for some months.

That’s normal.

The goal is improvement—not flawless tracking.

Financial systems should serve your life, not dominate it.

10. Celebrate Progress

Tracking expenses gives you something powerful: control.

Celebrate:

- Reduced unnecessary spending

- Increased savings

- Greater awareness

- Less financial anxiety

Positive reinforcement makes habits stick.

Common Mistakes to Avoid

- Tracking too many categories

- Switching systems frequently

- Trying to track every penny perfectly

- Quitting after one imperfect week

- Ignoring automation

Keep your system light, simple, and repeatable.

Conclusion

Tracking your expenses does not have to feel overwhelming.

To track your expenses without stress:

- Start with awareness

- Use broad categories

- Choose one method

- Review weekly

- Automate fixed costs

- Focus on trends

- Allow flexible spending

Financial clarity comes from consistency, not perfection.

When tracking becomes simple and sustainable, it becomes a powerful tool for building savings, reducing anxiety, and achieving long-term financial goals.