Your 20s are one of the most powerful financial decades of your life—even if it doesn’t feel like it yet.

At this stage, you may be paying off student loans, starting your first full-time job, building credit, or figuring out how to budget on your own. Investing might feel like something reserved for older, wealthier people. But in reality, your 20s give you something far more valuable than a high salary: time.

Time is the single most important factor in building wealth. Thanks to compound interest, money invested in your 20s has decades to grow. Even small, consistent contributions can turn into significant wealth by the time you reach your 40s, 50s, or retirement age. Waiting just five or ten years to start can cost you tens—even hundreds—of thousands of dollars in long-term growth.

In the United States, young adults have access to powerful investment tools, including 401(k) plans, Roth IRAs, brokerage accounts, index funds, and ETFs. But many people delay investing because they feel overwhelmed, confused, or afraid of losing money. The financial world can seem complicated—full of unfamiliar terms, market fluctuations, and conflicting advice.

The good news? You don’t need to be a financial expert to start investing. You don’t need thousands of dollars. And you don’t need to time the market perfectly.

What you do need is a simple strategy, a long-term mindset, and the willingness to begin.

In this guide, you’ll learn exactly how to start investing in your 20s in the U.S., step by step—including where to open accounts, how much to invest, what to invest in, and how to avoid common beginner mistakes.

Let’s build your financial future.

Step 1: Build a Financial Foundation First

Before investing, make sure you:

- Have at least a $1,000 emergency fund

- Pay off high-interest credit card debt

- Create a basic monthly budget

Investing while carrying 20%+ credit card interest rarely makes sense. Stability comes first.

Step 2: Take Advantage of Employer 401(k) Matching

If your employer offers a 401(k) with matching contributions, this is your first priority.

For example:

If your company matches 4%, contribute at least 4%.

This is essentially free money and an immediate return on your investment.

Your contributions are automatically deducted from your paycheck, making it effortless.

Step 3: Open a Roth IRA

If you qualify based on income limits, a Roth IRA is one of the best investment tools for young adults.

Why it’s powerful:

- You contribute after-tax money.

- Your investments grow tax-free.

- Withdrawals in retirement are tax-free.

Because you’re likely in a lower tax bracket in your 20s, paying taxes now and withdrawing tax-free later can be highly beneficial.

Step 4: Choose Simple, Low-Cost Investments

You don’t need to pick individual stocks to succeed.

Beginner-friendly options include:

- Index funds

- ETFs (Exchange-Traded Funds)

- Total market funds

- S&P 500 index funds

These investments provide diversification and historically steady long-term growth.

Avoid chasing “hot stocks” or trying to time the market.

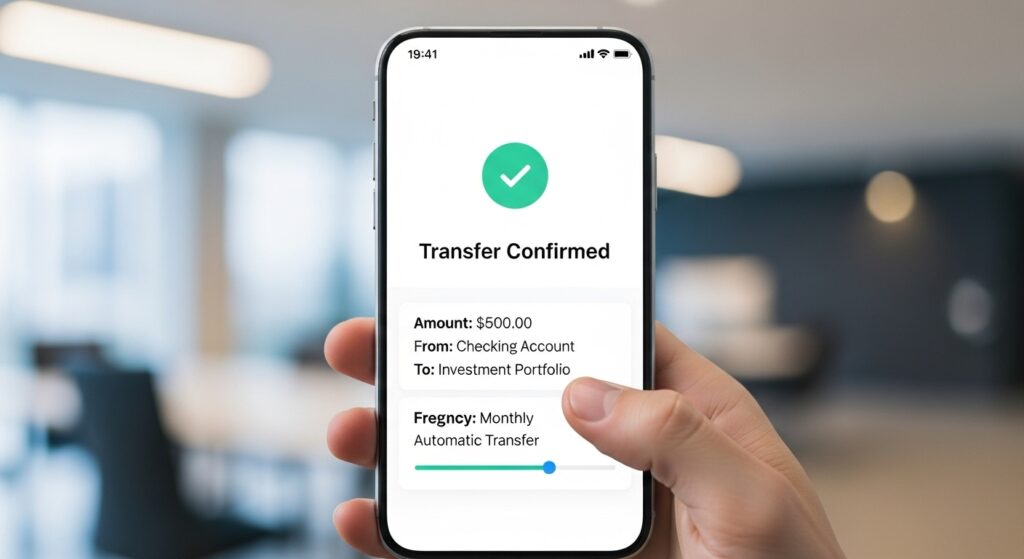

Step 5: Invest Consistently (Not Perfectly)

Consistency beats timing.

Set up automatic contributions:

- Monthly

- Biweekly

- With every paycheck

Even $100–$200 per month adds up significantly over time.

Example:

Investing $200/month starting at age 22 with a 7% average return could grow to hundreds of thousands by retirement.

Step 6: Understand Risk — But Don’t Fear It

Market fluctuations are normal.

In your 20s, you have:

- Time to recover from downturns

- Flexibility for long-term growth

- Higher risk tolerance

Short-term drops are not long-term failures.

Stay invested. Stay patient.

Step 7: Avoid Common Investing Mistakes

- Waiting for the “perfect time”

- Panic selling during downturns

- Investing money you need soon

- Ignoring fees

- Overcomplicating your portfolio

Simple often wins.

Conclusion

Starting to invest in your 20s in the U.S. is one of the smartest financial decisions you can make. The earlier you begin, the more powerful compound growth becomes.

You don’t need to be wealthy to start. You don’t need to understand every market detail. You just need to begin—consistently and patiently.

Investing isn’t about getting rich overnight. It’s about building financial security over decades.

Start small. Stay consistent. Let time work in your favor.

Your future self will thank you.